By Beth Blevins

Loan repayment programs in rural Nebraska are showing huge payoffs: family medicine providers who participate in them are significantly less likely to leave small towns and rural areas than those who don’t.

“We’re trying to maximize the impact and the opportunities for loan repayment in rural and urban underserved areas in the state,” said Thomas Rauner, Program Manager at the Nebraska Office of Rural Health (NORH). “So we are assessing how effective the programs are, and how are they working.”

Towards that end, NORH issued a report in July that examined the impact of incentive programs on retention of family practice providers—the most frequent specialty participating in loan repayment programs and serving in rural areas, Rauner said. The findings showed that these programs are especially effective in rural areas of the state—for example, participating small town and rural area providers are more likely to remain in their positions than non-obligated providers by 23% and 42%, respectively. They remain significantly longer by 2.3 years (small town) and 4.3 years (rural) than non-obligated providers.

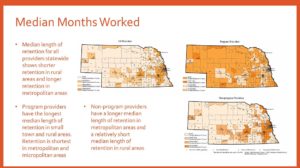

A sample visual from the “Analyzing the Impact of Incentive Programs on Retention of Family Practice Providers in Rural Nebraska” report.

One thing that makes the report interesting, Rauner said, is that it offers visual representations of the data. “We’ve been working in the last few years to come up with more visualization components,” he said. “You can look at number, but a picture makes it easier to understand and share with a much broader group.” In the future, he said, they will share data by a place-based and legislative format.

Though the report was issued earlier this year, it has been in the making for nearly two decades with resources from the State Office of Rural Health and Primary Care Office grant programs, Rauner said. “The data on family medicine providers was analyzed by a graduate student intern in our office, using information from the University of Nebraska Medical Center (UNMC) Health Professions Tracking Service (HPTS), which they collaborated with our office to develop over 20 years ago,” he said.

HPTS tracks providers enrolled in all state and federal loan repayment programs during and after their obligation, Rauner said. “Using HPTS, we’re able to track all the healthcare providers in our state,” he said. “The system also allows them not only to track whether physicians who served their obligation out there stay longer in practice than those who did not have obligations, but also gives them the capacity to look at that data over time.”

HPTS data can also be used for economic analysis, Rauner said. “Some of the more interesting findings from the report was that analysis based on years worked shows there is a significant economic benefit associated with rural healthcare providers—a total of $3.6 billion,” he said. “This benefit far outweighs the financial investment in incentive programs.”

HPTS tracks physicians as well as dentists, physician assistants, nurses, graduate-level mental health providers, and allied health providers—those who qualify for loan repayment in the state. Its data also has been used by UNMC authors for reports on primary care nurse practitioners, on physician assistants, and on the status of healthcare workforce in the state.

In addition to HPTS, Rauner said, NORH uses the Practice Sights Retention Management System “to solicit feedback from the providers while serving their obligation, determining if they would like and need to continue receiving loan repayment assistance, and their anticipated and actual retention.”

The data from the two systems benefit both providers and communities, Rauner said. “There are many variables when it comes to assessing workforce needs,” he said. “Each community desires the right care, right time, right place, and the right cost. NORH is continuing to work with communities to develop such a system of care, while working to improve the process and utility of loan repayment programs.”

With the proven success of the loan repayment programs in Nebraska, NORH also has been working to get more healthcare students enrolled in them. “We’ve been trying to simplify it as much as possible,” Rauner said. “We recently combined and changed our loan repayment applications to be a single online application. This will allow NORH to track and process applications for loan repayment and determine the best fit for the provider and the site.”

————————————————————————————

Does your SORH have a “Promising Practice”? We’re interested in the innovative, effective and valuable work that SORHs are doing. Contact Ashley Muninger to set up a short email or phone interview in which you can tell your story.